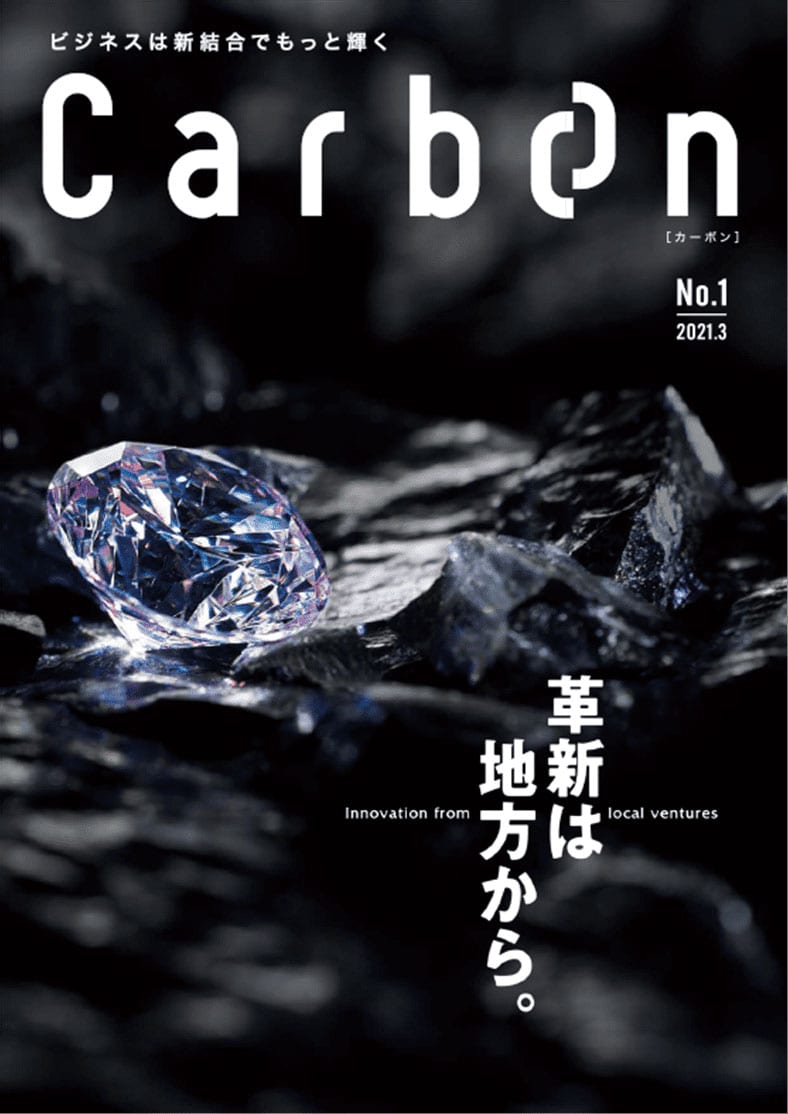

About "Carbon"

ビジネスは

新結合で

もっと輝く

「Carbon(カーボン)」=「炭素」は、

結びつき方次第でさまざまな性質を発現します。

同様に、企業と企業とが協業によって

結びつくとき、

さまざまなイノベーションが生み出され、

ビジネスはもっと輝きはじめることでしょう。

「Carbon」は、雑誌とWEBで情報を発信する

複合メディア。

一般企業とベンチャー企業やスタートアップとをつなぐ“架け橋”となることを目指して、

未来を見据えるビジネスパーソンに向け、協業や共創の価値をお伝えします。